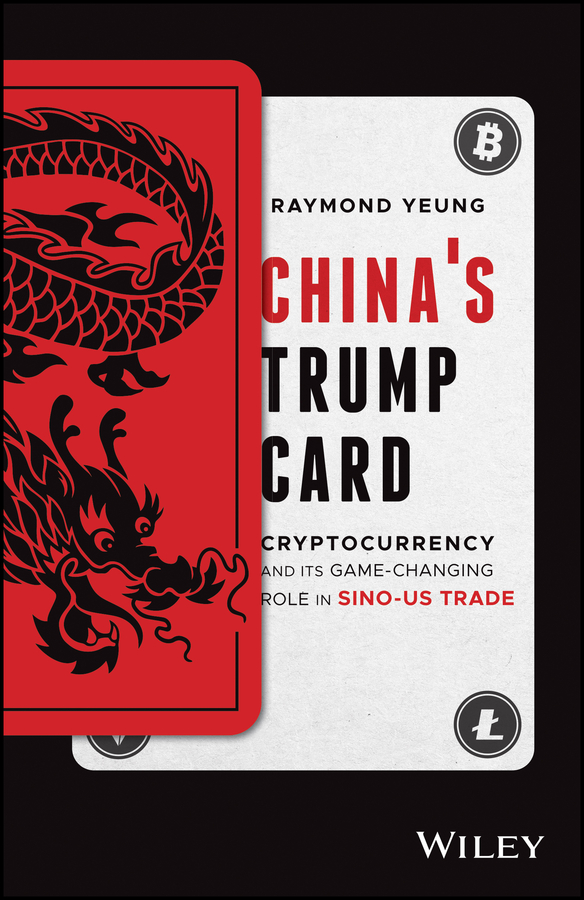

<p><b>Discover the impact of blockchain on the trade relationship between the </b><b>world’s two largest economies</b> </p> <p><i>China’s Trump Card: Cryptocurrency and its Game-Changing Role in Sino-US Trade</i> grapples with the fascinating issue of the effect of digital currencies on world trade and the relationship between China and the United States in particular. Full of forward-looking insights, solid data analysis, extensive collection of relevant literature and incisive observations, author Raymond Yeung compellingly argues that cryptocurrencies will have a significant role to play in harmonizing geopolitical power struggles. </p> <p>Covering all the subjects required for a full understanding of the future of the Sino-US trade relationship, <i>China’s Trump Card </i>discusses: </p> <ul style=”margin-bottom: 0in; font-size: medium; margin-top: 0in; user-select: text; -webkit-user-drag: none; -webkit-tap-highlight-color: transparent; cursor: text; overflow: visible;” type=”disc”> <li style=”margin: 0in 0in 0.0001pt 0.25in; font-size: 11pt; font-family: Calibri, sans-serif; vertical-align: baseline; user-select: text; -webkit-user-drag: none; -webkit-tap-highlight-color: transparent; cursor: text; overflow: visible;”>The looming risks of de-dollarization in the wake of de-globalization </li> <li style=”margin: 0in 0in 0.0001pt 0.25in; font-size: 11pt; font-family: Calibri, sans-serif; vertical-align: baseline; user-select: text; -webkit-user-drag: none; -webkit-tap-highlight-color: transparent; cursor: text; overflow: visible;”>The pressing need to construct a new currency standard superior to the fiat money regime in response to the global imbalance. </li> <li style=”margin: 0in 0in 0.0001pt 0.25in; font-size: 11pt; font-family: Calibri, sans-serif; vertical-align: baseline; user-select: text; -webkit-user-drag: none; -webkit-tap-highlight-color: transparent; cursor: text; overflow: visible;”>China’s diversification of its offshore portfolios to include alternative investments </li> <li style=”margin: 0in 0in 0.0001pt 0.25in; font-size: 11pt; font-family: Calibri, sans-serif; vertical-align: baseline; user-select: text; -webkit-user-drag: none; -webkit-tap-highlight-color: transparent; cursor: text; overflow: visible;”>The implications of Facebook’s plan to create a blockchain-based digital currency </li> <li style=”margin: 0in 0in 0.0001pt 0.25in; font-size: 11pt; font-family: Calibri, sans-serif; vertical-align: baseline; user-select: text; -webkit-user-drag: none; -webkit-tap-highlight-color: transparent; cursor: text; overflow: visible;”>The fact that blockchain offers a fungible asset class option for China’s reserves investment, which can be relatively independent of political considerations </li> </ul> <p>This book is perfect for business leaders, investors, financial analysts, policymakers, economists, fintech developers and others who have a stake in the outcome of the blossoming trade disputes between the United States and China. </p>

China’s Trump Card

₹2,441.00

Cryptocurrency and its Game-Changing Role in Sino-US Trade

This book is currently not in stock. You are pre-ordering this book.